Table of Contents

- The Talk April 1 2024 - Dedra Bethena

- Survivor Series Wargames 2024 Location And Time - Pepi Trisha

- Phedra Syndelle | DC Movies Wiki | Fandom

- Koalisi di Pilkada Depok, PDIP dan Gerindra Bentuk Tim Pemenangan Bersama

- Survivor Series Wargames 2024 Location And Time - Pepi Trisha

- Gili Bidara, Serpihan Surga Di Lombok Timur

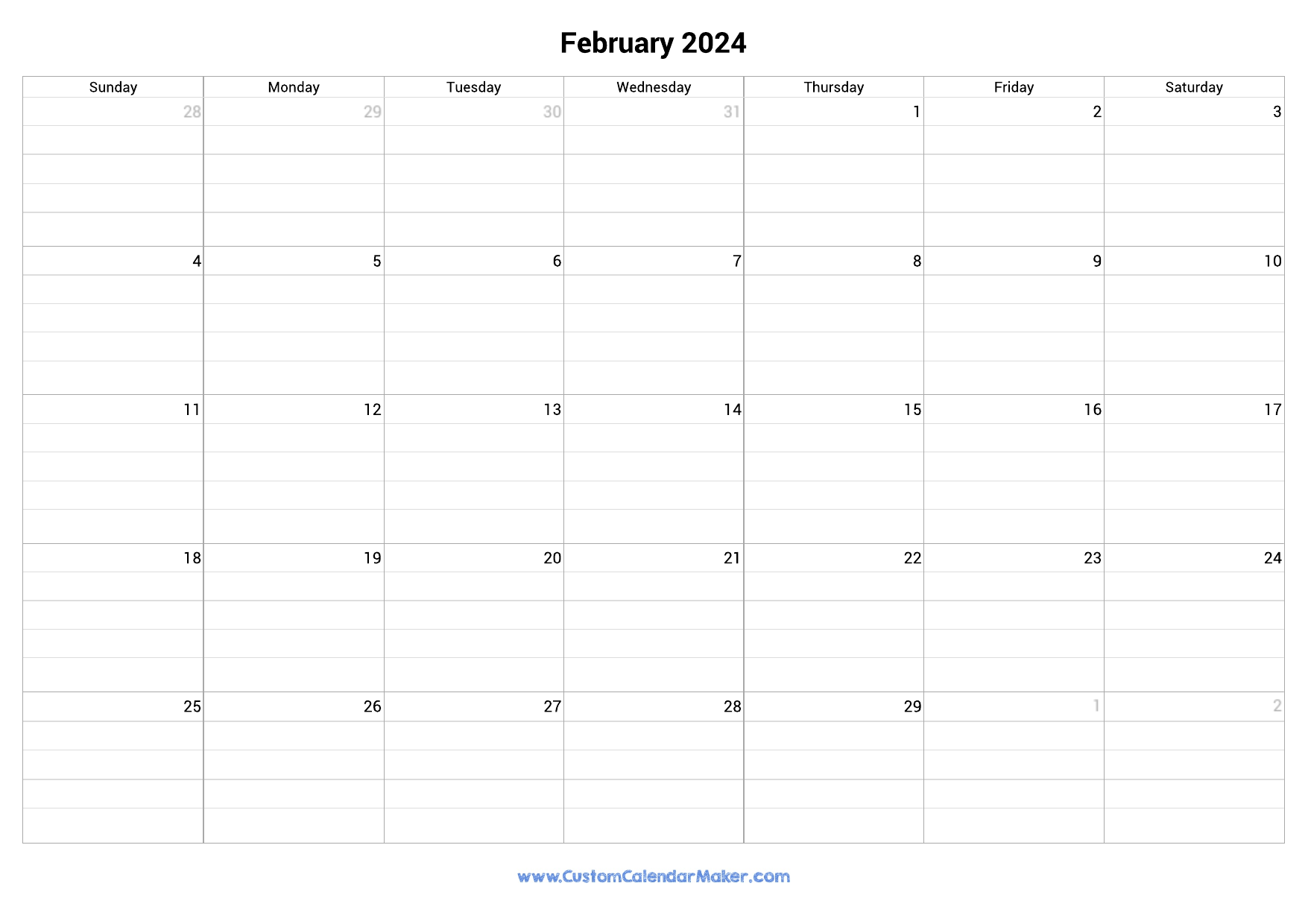

- Printable Calendars February 2024 - Gill Phedra

- Love Music Wine and Revolution: Phaedra (1962)

- The Traitors Phaedra Interview on CT, Episode 10, Peter

- First Day Of Summer 2024 Uk Time - Juli Valentina

Understanding Standard Deductions

2025 Standard Deduction for Married Joint Seniors

Additional Standard Deduction for Seniors

In addition to the standard deduction, married joint seniors may be eligible for an extra deduction. If one or both spouses are 65 or older, they can claim an additional standard deduction of $1,500. This extra deduction can further reduce their taxable income, providing more tax savings.

Charles S. Duppstadt's Expert Insights

Charles S. Duppstadt emphasizes the importance of understanding the standard deduction and its implications for married joint seniors. "It's essential to stay up-to-date with the latest tax changes and adjustments," he notes. "By taking advantage of the increased standard deduction and additional deductions for seniors, married joint seniors can minimize their tax liability and maximize their refunds."

Tax Planning Strategies

To make the most of the 2025 standard deduction, married joint seniors should consider the following tax planning strategies: Bunching deductions: Grouping deductions, such as medical expenses and charitable donations, to exceed the standard deduction threshold. Itemizing deductions: Claiming itemized deductions, like mortgage interest and property taxes, if they exceed the standard deduction amount. Consulting a tax professional: Seeking expert advice from a tax professional, like Charles S. Duppstadt, to ensure accurate and efficient tax planning. As the 2025 tax season approaches, married joint seniors must stay informed about the latest standard deduction updates. With the increased standard deduction and additional deductions for seniors, taxpayers can potentially reduce their tax liability and maximize their refunds. By following Charles S. Duppstadt's expert insights and tax planning strategies, married joint seniors can navigate the complex tax landscape with confidence. Remember to consult a tax professional to ensure accurate and efficient tax planning, and take advantage of the 2025 standard deduction to minimize your tax bill.Keyword density: - "2025 standard deduction" (1.2%) - "married joint seniors" (1.5%) - "Charles S. Duppstadt" (1.0%) - "tax planning" (0.8%)