Table of Contents

- Medicare and Income Related Monthly Adjustment Amount - Ricky Credille ...

- WHAT DOES IRMAA HAVE TO DO WITH YOUR MEDICARE PREMIUMS IN 2024? - Blair ...

- Do You Have Questions About Your Medicare Plan? | Brion Harris ...

- Medicare Irmaa 2024 Part D - Emma Norina

- 2024 Medicare IRMAA Explained - YouTube

- Medicare and Income Related Monthly Adjustment Amount - Ricky Credille ...

- Medicare and Income Related Monthly Adjustment Amount - Ricky Credille ...

- Irmaa 2024 Medicare Rates Brackets - Mab Felicle

- 2024 Medicare IRMAA Explained - YouTube

- 2024 Medicare IRMAA Explained - YouTube

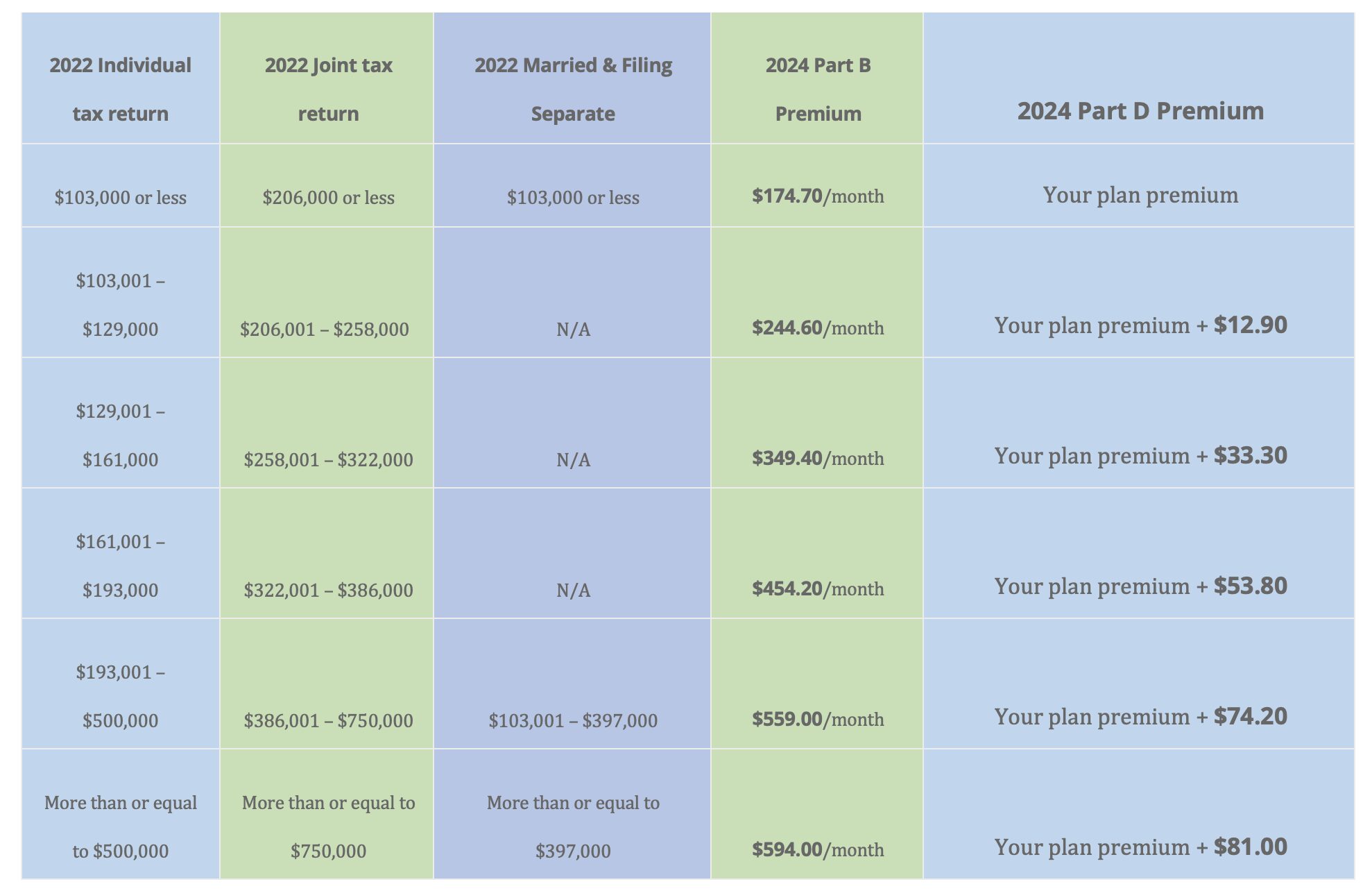

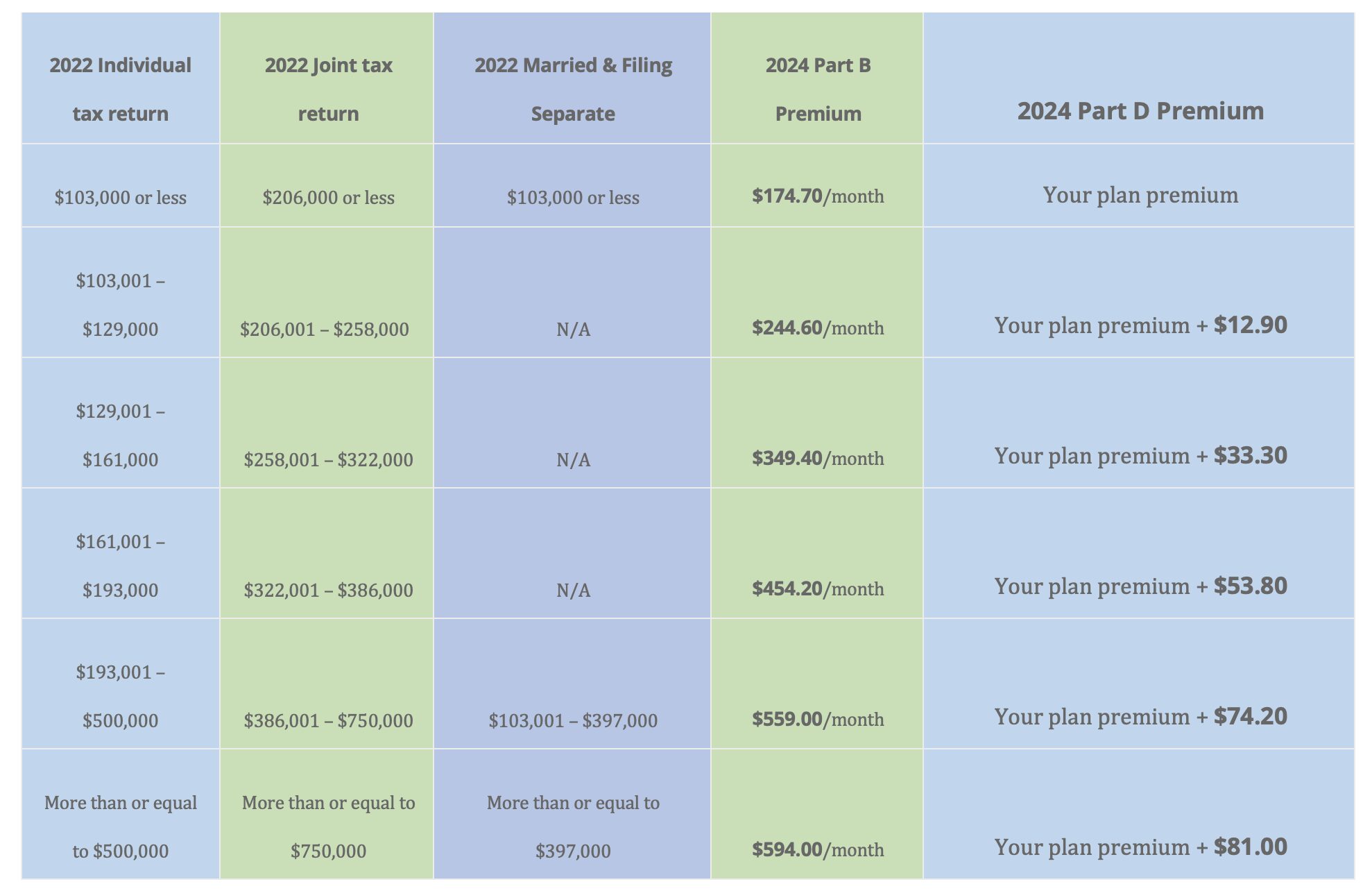

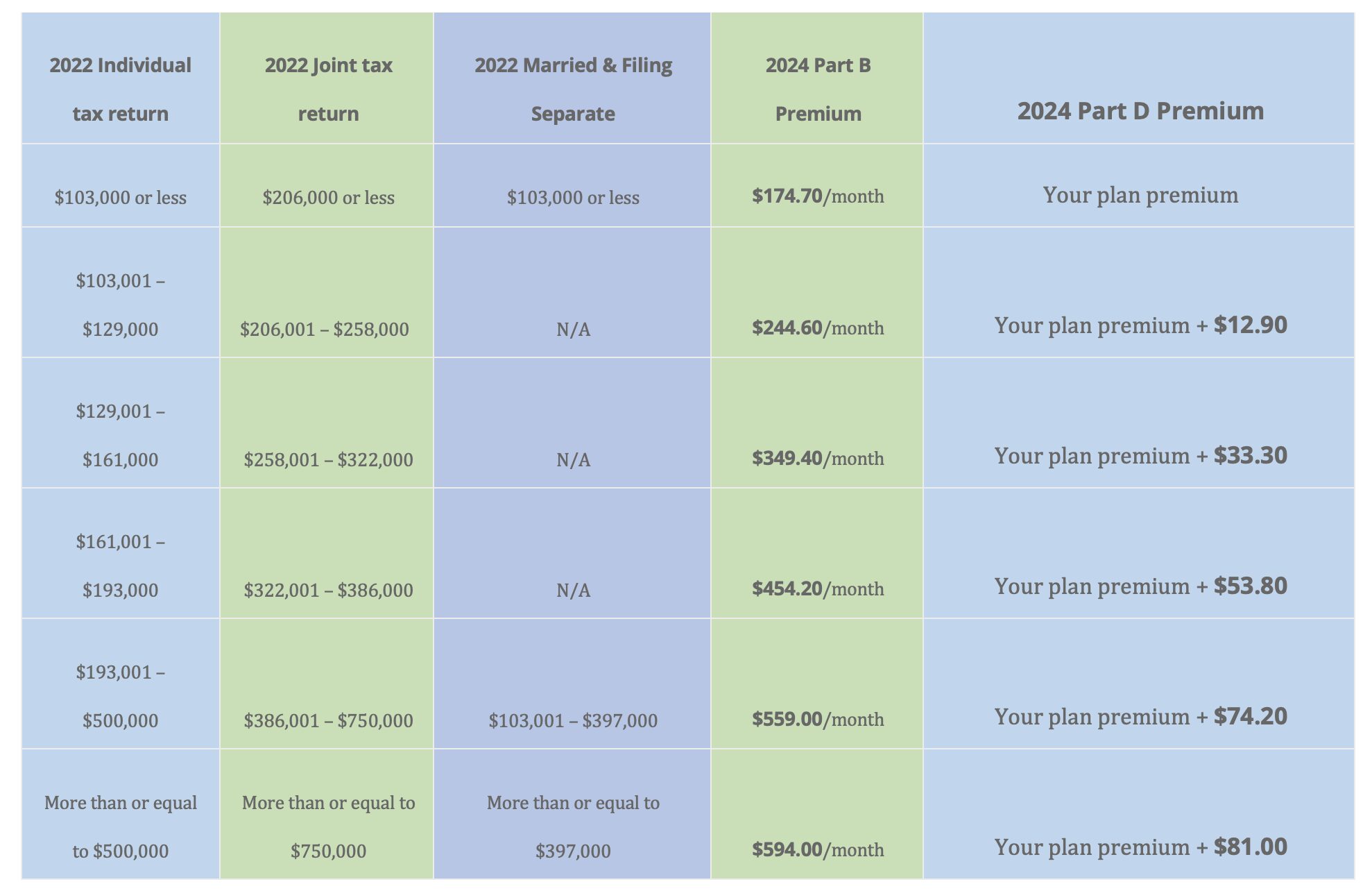

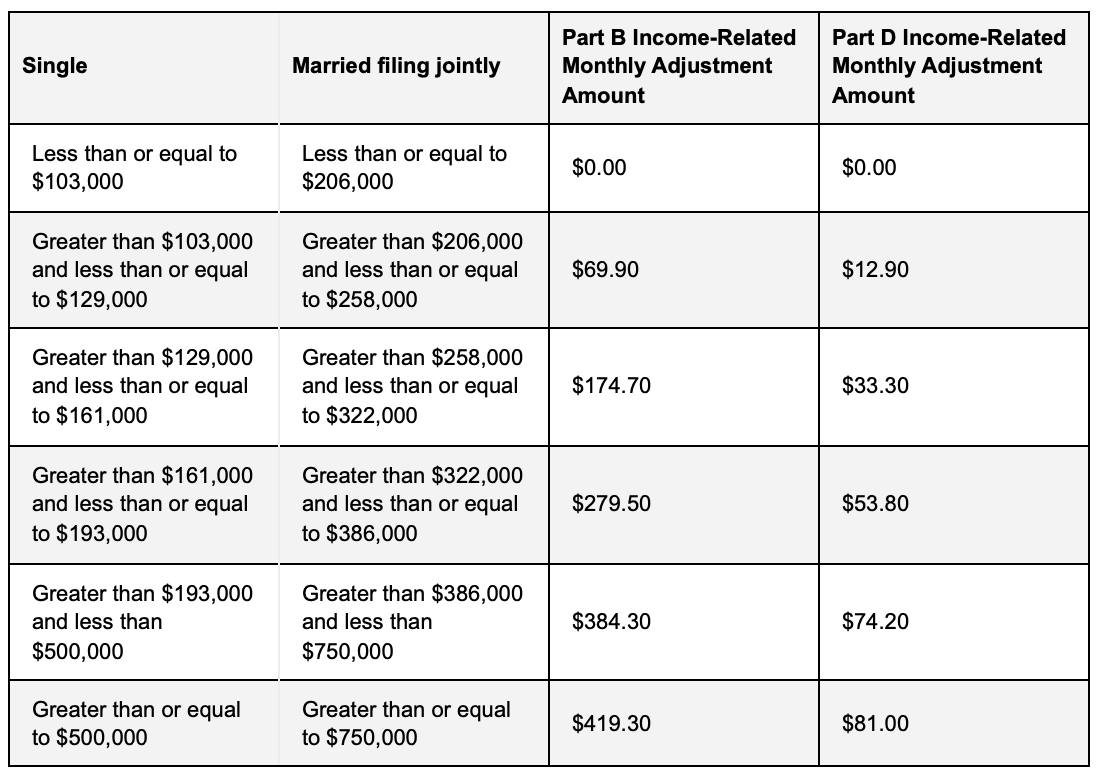

Understanding IRMAA and Its Impact on Medicare Costs

Why 2026 Medicare IRMAA Tax Planning is Crucial

Strategies for Minimizing IRMAA Liability

There are several strategies you can use to minimize your IRMAA liability: Convert traditional IRAs to Roth IRAs: Converting traditional IRAs to Roth IRAs can help reduce your MAGI and minimize your IRMAA surcharge. Harvest investment losses: Selling investments that have declined in value can help offset gains from other investments and reduce your MAGI. Delay income: Delaying income, such as retirement account distributions or capital gains, can help reduce your MAGI and minimize your IRMAA surcharge. Consider a qualified charitable distribution (QCD): Making a QCD from your IRA can help reduce your MAGI and minimize your IRMAA surcharge.