Table of Contents

- Top Reits For 2024 - Fanya Jemimah

- Best 10 REITs performance in Malaysia 2023

- Top 10 REITs For The 'Silent Generation' | Seeking Alpha

- Top 10 REITs For 2021 | Seeking Alpha

- Top Rated Reits 2024 - Dana Milena

- Front & Center Podcast: Episode 28 – 2024 Outlook Series: Global ...

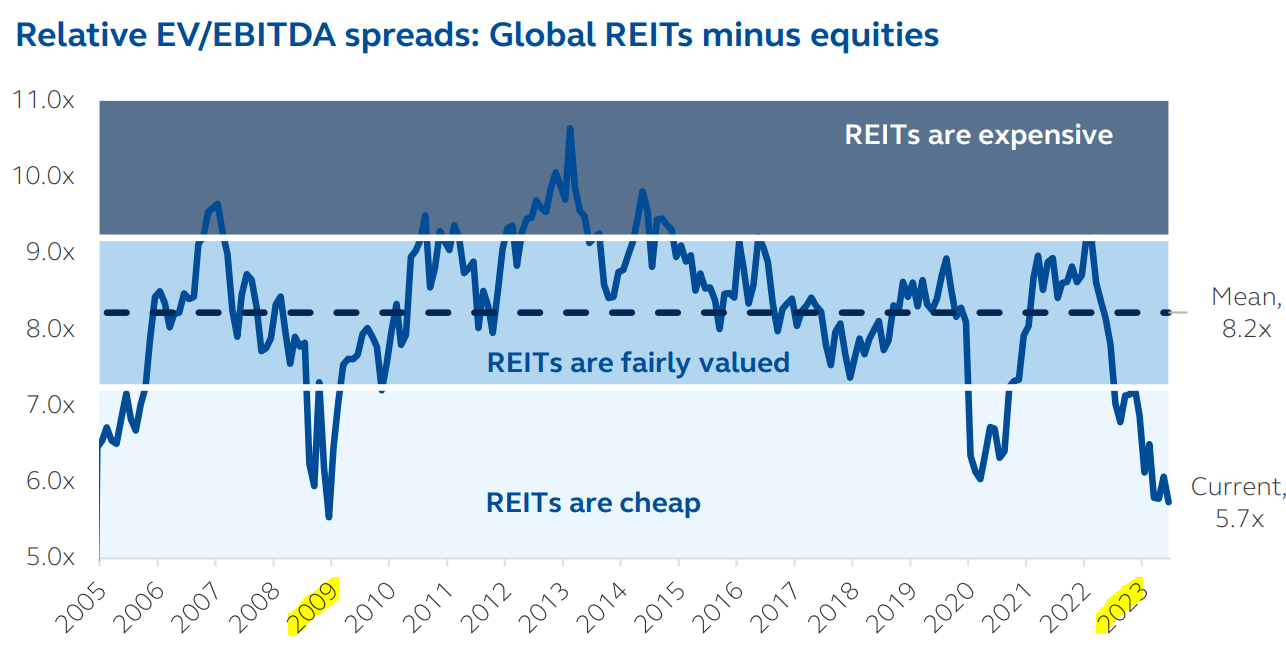

- Unlocking Value For Investors

- 10 REITs To Buy In 2024 | Seeking Alpha

- 4 REITs that could outperform in 2023 - TheFinance.sg

- Melihat Tren Properti di 2025, Bakal Seperti Apa? - Bisnis Liputan6.com

1. Simon Property Group (SPG)

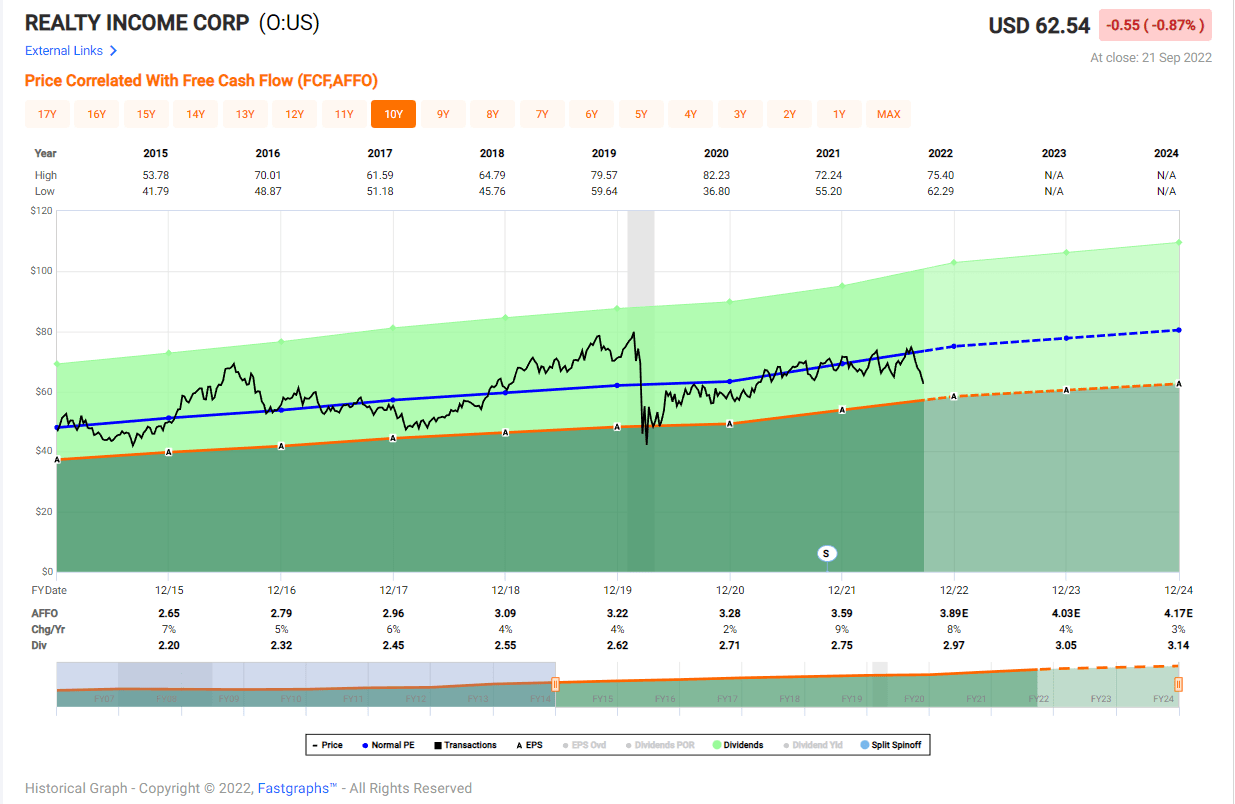

2. Realty Income (O)

:strip_icc():format(webp)/kly-media-production/medias/4314205/original/086508800_1675591991-8b2eff85-e88f-4b82-a6df-cd2aa7a1df4c.jpeg)

3. National Retail Properties (NNN)

National Retail Properties is a retail REIT that invests in high-quality, single-tenant properties. The company's portfolio is diversified across various industries, including retail, restaurants, and banking. With a dividend yield of around 4.5%, NNN offers an attractive combination of income and growth potential. The company's strong financials and experienced management team make it a compelling choice for investors.

4. Welltower (WELL)

Welltower is a healthcare REIT that focuses on medical office buildings, outpatient facilities, and senior housing. The company's diverse portfolio and strong partnerships with leading healthcare providers make it an attractive choice for investors. With a dividend yield of approximately 4.1%, Welltower offers a significant source of income, combined with potential for long-term growth.