Table of Contents

- 2026 Tax Brackets: Why Your Taxes Are Likely to Increase in 2026 and ...

- 2024 Vs 2026 Tax Brackets - Aimee Atlante

- Will Tax Rates Sunset In 2026? How to Plan Ahead - YouTube

- Tax Brackets Married Filing Jointly 2024 - Hedda Guglielma

- 2025 Vs 2026 Tax Brackets - List of Disney Project 2025

- 2026 Income Tax Increase - YouTube

- Irmaa Brackets 2025 And 2026 - Marshall T Tipton

- 2026 Income Tax Increase - YouTube

- Planning for Personal Tax Laws Changing in 2026 | Mercer Advisors

- Navigating the 2025 Tax Landscape: Changes on the Horizon for Taxpayers

What are Tax Brackets?

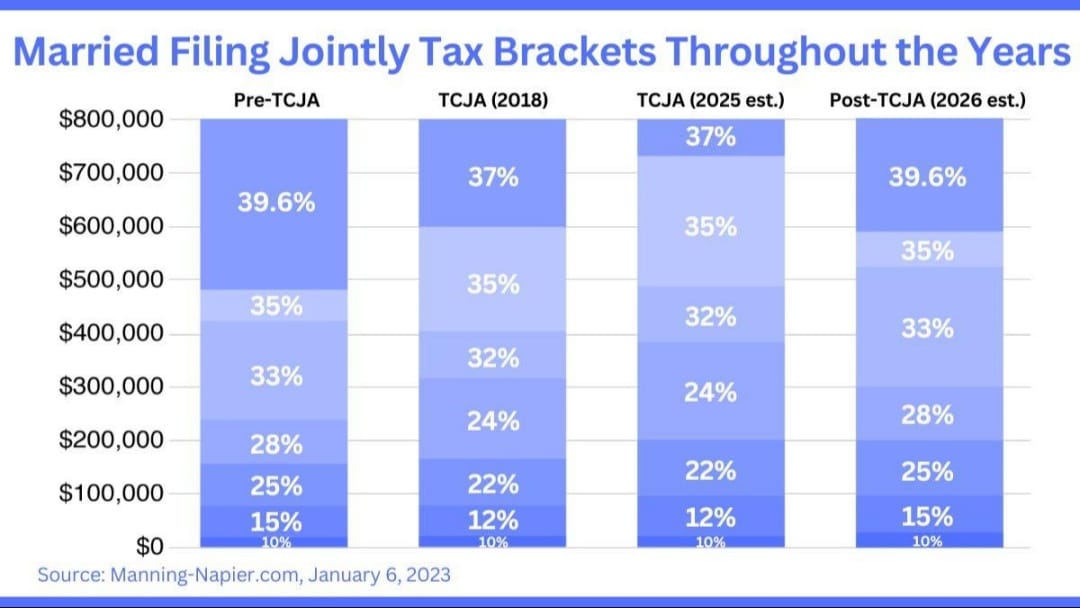

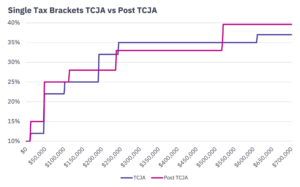

2026 Tax Bracket Changes

How Will the 2026 Tax Bracket Changes Affect You?

The 2026 tax bracket changes may impact your tax liability, depending on your income level and filing status. If you're a single filer with an income above $609,350 or a joint filer with an income above $731,200, you'll be subject to the top tax rate of 37%. On the other hand, if you're a low-to-moderate income earner, you may benefit from the increased standard deduction.